Why REN Skincare Is Shutting Down — A Reflection on Relevance in a Saturated Beauty Market

Thought Leadership Series

Has REN Skincare Lost Its Relevance — Or Was It Simply Outpaced?

Earlier this year, murmurs about REN Skincare’s uncertain future grew louder. Once a trailblazer in the clean beauty movement, REN may now be preparing to quietly exit the stage. Owned by Unilever since 2015, the brand that once captured the attention of conscious consumers has recently shown signs of stagnation — vanishing from key retailers, pulling back on launches, and losing visibility in a hyper-competitive space.

But is this really about “relevance,” as many in the industry suggest? Or are we witnessing the natural outcome of big conglomerates streamlining portfolios and shifting strategies?

And more broadly: how do brands truly stay relevant in a overly saturated, ever-evolving market?

From Disruption to Disappearance: The Rise and Stall of REN

Founded in 2000 in the UK, REN (short for “clean” in Swedish) was ahead of its time. Long before “clean beauty” became a buzzy marketing term, REN committed to avoiding harsh chemicals and using more skin-friendly alternatives — all while delivering luxury formulations that felt modern and sensorial.

For a while, this worked beautifully. REN built trust with consumers, earned space in premium retailers, and carved out a niche in what was then a fledgling clean category.

Fast-forward to 2015: REN is acquired by Unilever. At the time, this was seen as a smart move — a legacy company betting on the future of natural, clean skincare. But within a few years, the clean beauty landscape exploded with competition. Indie brands began flooding the market with similar promises — and often, flashier branding, sharper social media presence, and faster innovation cycles.

The term “clean” became diluted. And REN’s once-distinct positioning was no longer unique.

A Crowded Field With Fewer Lanes

There’s no shortage of “clean,” “green,” or “ethical” skincare brands today. Consumers scroll through dozens of brands that all tout similar values: sustainability, transparency, science-meets-nature formulas, and skin minimalism.

While these are admirable ideals, they’ve become expected — no longer differentiators, but table stakes.

Brands like Drunk Elephant, Youth to the People, Summer Fridays, and The Ordinary each carved out their own edge:

- Drunk Elephant focused on its “Suspicious 6” philosophy and minimalism (even if that felt surface-level).

- The Ordinary went ultra-affordable and ingredient-led, essentially democratising actives.

- Youth to the People leaned into superfoods and functional wellness aesthetics.

Even if you disagree with their formulas, pricing, or approach — they have a hook. Something REN may have lost in recent years.

Did Unilever Simply Have Too Many Brands?

Unilever’s beauty and personal care portfolio is enormous — and highly diversified. (Dermalogica, Kate Somerville, Murad, Paula’s Choice, Tatcha, Hourglass, Living Proof, Garancia, Schmidt’s Naturals, Wild, Minimalist, K18, BYBI Beauty, Gallinée, Straand and many more). It includes everything from mass-market staples like Dove to prestige players like Paula’s Choice and Hourglass.

When conglomerates acquire indie brands, they often aim to scale them through global distribution and supply chain optimisation. But what sometimes gets lost in the process is vision. Brands that were once founder-led and agile can become slower, less distinctive, and increasingly subject to corporate performance metrics.

This may well be part of what happened to REN.

In 2024, Unilever appointed Hein Schumacher as CEO and publicly committed to rationalising its portfolio to improve margins. That likely means cutting underperforming or plateauing brands. If REN wasn’t hitting key growth targets — or if its product innovation pipeline was lagging — it might have made sense to quietly phase it out.

So: did REN lose relevance? Or did it just become misaligned with Unilever’s expectations for scale?

Could REN Have Repositioned?

Yes — and this is where it gets interesting.

In theory, almost any brand can reposition. Relevance isn’t static. It’s contextual. Brands fall in and out of relevance depending on how well they respond to shifts in culture, science, values, and storytelling.

Just look at:

- Paula’s Choice: Once considered old-school and clinical, it found renewed energy by leaning into education, transparency, and digital marketing.

- Typology: Built a modern minimalistic brand for ingredient-savvy Gen Zs, with a tight product range and French pharmacy appeal.

- Glow Recipe: Used juicy branding and “skin as fruit” storytelling to make Korean skincare trends mass-appealing.

REN, by contrast, remained somewhat caught in a no-man’s land — not fully clinical, not fully luxury, not quite indie. It didn’t own a bold enough story.

The lesson? Reinvention requires clarity of voice and speed of execution. And not every corporate structure allows that.

The Role of Founders & Personality-Driven Brands

Some have pointed to Trinity Mouzon Wofford (Golde), or Caroline Hirons (Skin Rocks), or even Gwyneth Paltrow (Goop) as examples of how personality sells. These brands are often magnetic because of the person behind them.

But that raises a fair question: Are these brands truly relevant, or are they just buoyed by public figures with loyal followings?

In many cases, the founder is the brand — which can be powerful, but fragile. If the personality fades from view, does the brand still stand?

And that’s why we’re seeing a rising need for personality brands to evolve into brand identities. To grow beyond the individual. To become known for something more than the founder’s voice — whether that’s through distinctive formulations, a clear skincare philosophy, or a disruptive model that consumers believe in.

This is exactly where I’ll go in our next blog: “When Personality Isn’t Enough: Why Founder-Led Brands Must Build Real Brand Identity.”

What This Means for Indie Brands Today

If you’re building a skincare brand in 2025 and beyond, the REN story is worth studying. It reminds us that:

- Values without distinction aren’t enough

- Scale without soul weakens brand DNA

- Even if you got investment, you are not safe

- And even brands with a great origin story can fade if they don’t continually evolve

At NAYA, I’m seeing this firsthand. It’s not easy to communicate the why behind every ingredient, to translate scientific care into consumer excitement, or to justify a higher price point in a world dominated by fast beauty and price wars.

But true differentiation comes from conviction. From staying close to your community. From building something that can’t be copied in a few months by a white-labeled competitor.

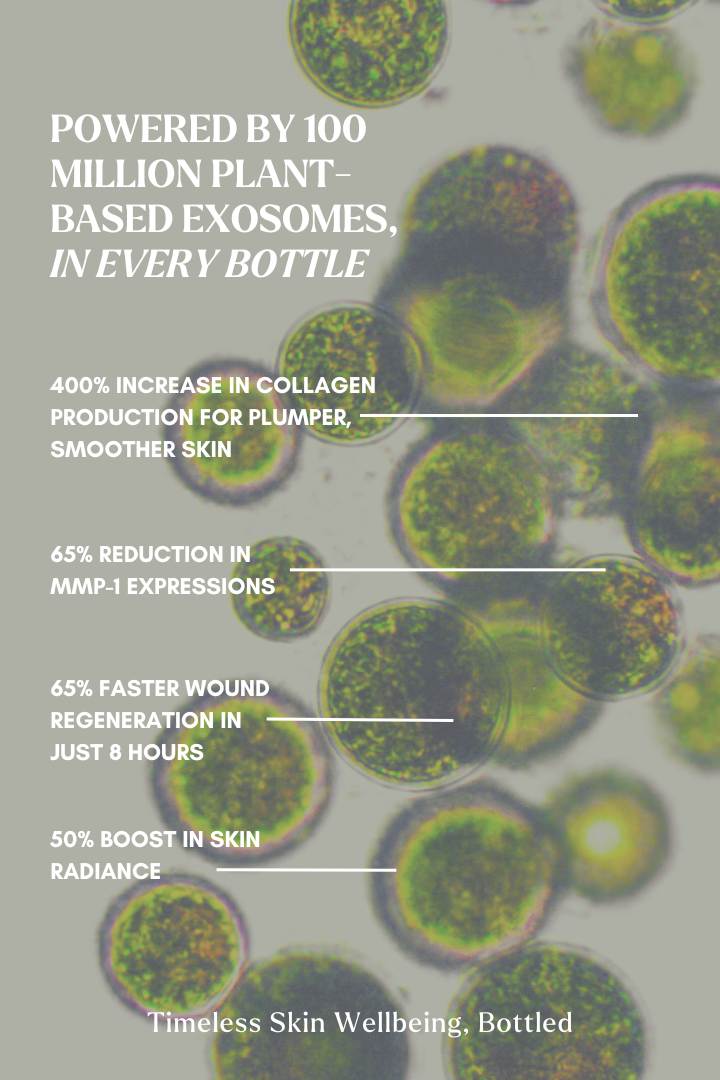

So, what can we learn from REN’s downfall? It’s about more than just ingredients or flashy marketing — it’s about creating skincare that lasts. At NAYA, we don’t just follow trends; we craft products based on deep science, high-quality ingredients, and a commitment to sustainable beauty. NAYA's Exosomes skincare collection is a perfect example of how we’re shaping the future of skincare with powerful, results-driven formulations.

So, Did REN Lose Relevance?

In part — yes. But it was also outpaced, under-innovated, and possibly under-prioritised in a portfolio too large to serve every brand equally.

In a sea of sameness, even the strongest swimmers need to keep moving.

I used to work at a venture capitalist firm, where I was responsible for evaluating startup pitches and potential investments — particularly within the wellness and beauty space. And what I learned, again and again, is this: at the end of the day, it comes down to numbers — sales performance and cost to scale. No matter how beautiful the brand, how passionate the founder, or how compelling the mission, if a product line underperforms or stalls while others in the portfolio accelerate, resources inevitably shift. In REN’s case, it wasn’t just about relevance; it was about being outpaced in a pond full of faster-moving sharks. It simply didn’t get the backing needed to swim alongside bolder, louder competitors.

🚀 Up Next:

“When Personality Isn’t Enough: Why Founder-Led Brands Must Build Real Identity” — stay tuned for a deeper dive into the evolution of celebrity and founder-led beauty brands.

Leave a comment